Figuring out how to calculate your actual workers’ compensation cost per employee means referring to your current policy to determine your annual premium and your rates per hundred of payroll for each of your classification codes.

Note: Once you have a policy, your insurer will perform an audit to ensure you are paying the correct amount of premium based on how many employees you have and what their job descriptions are.

In general, workers’ compensation insurance premiums are based on the risk of experiencing claims costs combined with the value of what is being insured. In this case, risk is considered the potential cost of future workplace injuries (which is based on the costs of past claims) within each industry, safety programs, your loss experience and the zip code that your business operates in.

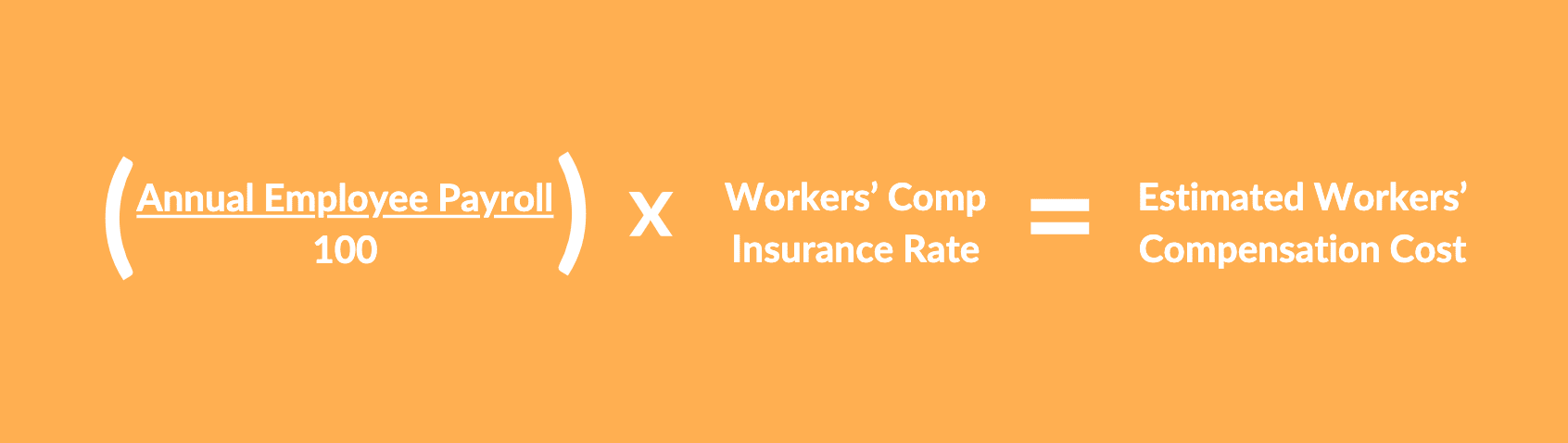

Here’s a basic formula to estimate your workers’ compensation cost for an employee:

The exact formulas that insurers use to determine your workers’ compensation premium have many moving parts, and how they calculate your premiums can be slightly different from one another. What’s more, these formulas depend on the workers’ compensation laws in each state.

1. Determine the class code of your employee.

Class codes are assigned based on the industry of your business. Depending on your state, workers’ compensation class codes are either set by your state workers’ comp agency or by the National Council on Compensation Insurance.

Class codes are based on work duties and risk levels associated with that type of work. Data from each class code gets assessed to determine a rate based on workplace injuries and workers’ compensation claims.

To determine your classification code, consider what products or services you sell, what types of tasks your employees perform, and if there are contractors or subcontractors that also need coverage.

2. Find out the premium rate for the employee’s class code.

You can ask different workers’ compensation insurance providers for their rates by class code. The rate will be given in dollars and cents for each $100 of payroll for each class code.

In most states, insurers are allowed to charge at their own discretion against the advised rates published by the state’s rating agency. But in Florida for example, the state sets the rates.

To ensure that you find the best price for your business, it’s recommended that you request quotes from a variety of workers’ compensation insurance providers. This is why E-COMP works with over 50 workers’ compensation provides, which allows us to shop the marketplace to find the best pricing with the most coverage.

3. Determine your annual payroll for each employee and then do some basic math.

Calculating your workers’ compensation cost per employee involves understanding your payroll numbers. Take into consideration all your employees who are full-time, part-time, temporary, or seasonal. If you’re unable to calculate the gross payroll for each employee, you can estimate the projected payroll.

NOTE: If you come to the end of your policy year and you are not on pay-as-you-go, your final workers’ compensation premium can be adjusted to account for initial over- or under-estimated payroll projections.

Once you have the estimated annual payroll for the employee, divide that number by 100. You then multiply that number by the premium rate for the class code to find the total cost of workers’ compensation insurance for that employee.

Remember, the steps we just went through for how to calculate the workers’ compensation cost per employee will give you a very rough estimate. Other factors—such as the number of employees, location, taxes and your experience modification—can influence how much workers’ compensation costs.

Sounds complicated? Consider skipping the math and contact an E-COMP Specialist, who are skilled experts and can make workers’ compensation insurance easy. Learn more about how workers’ compensation insurance can protect your small business.

Insurance services provided by Granite Insurance Brokers and its licensed agents and affiliates. The information contained within these materials are confidential and not to be distributed. Descriptions are general in nature only. Please refer to the terms and conditions of policies offered or purchased. Insurance products are subject to application and underwriting requirements. Pricing depends on a variety of factors including policyholder location. Not all discounts available in all states. Not all products available in all states. Use of and access to this information, site or any of the links contained within this site does not create a relationship between the user and Granite. © 2025 Granite Insurance Brokers, Inc. All Rights Reserved.